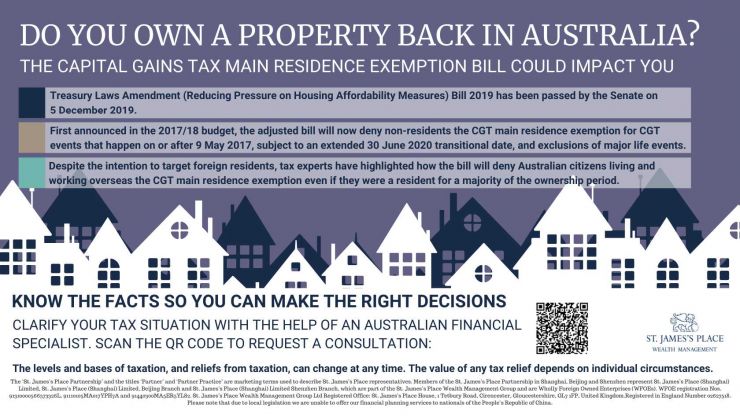

Capital Gains Tax Main Residence Exemption Bill

As you might know the primary residence Capital Gains Tax(CGT) bill passed the Senate without amendment on 5 December 2019. If you own a property in Australia, here is what you need to know about the new amendment.

- Treasury Laws Amendment (Reducing Pressure on Housing Affordability Measures) Bill 2019 has been passed by the Senate on 5 December 2019.

- First announced in the 2017/18 budget, the adjusted bill will now deny non-residents the CGT main residence exemption for CGT events that happen on or after 9 May 2017, subject to an extended 30 June 2020 transitional date, and exclusions of major life events.

- Despite the intention to target foreign residents, tax experts have highlighted how the bill will deny Australian citizens living and working overseas the CGT main residence exemption even if they were a resident for a majority of the ownership period.

Clarify your tax situation with the help of an Australian financial specialist. Scan the QR code to request a consultation: